11 Best Forex No-Deposit Bonus Forex Brokers

Last Update: March 16th, 2024

The 11 Best Forex No-Deposit Bonus Forex Brokers revealed. We have explored and tested several prominent platforms to identify the Top 11 Forex Brokers with No Deposit, Sign-Up, and Welcome Bonus offers.

In this in-depth guide, you’ll learn:

- The Top No-Deposit, Sign-Up, Welcome Bonus Brokers – a List (2024)

- Top $30, $50, $100, $200, and $500 No-Deposit Forex Bonus Offers

- Top 10 Forex Brokers (Tickmill, InstaForex, XM) with Free, Withdrawable Bonus Offers

- Highest No Deposit Bonus Offers in Forex for Beginners

and much, MUCH more!

11 Best No-Deposit Bonus Forex Brokers – a Comparison

| 🔎 Broker | 🎁 Bonus Offer | 💴 Bonus Amount | 🚀 Open an Account |

| 🥇 XM | ✅Yes | $30 USD | 👉 Click Here |

| 🥈 JustMarkets | ✅Yes | $30 USD | 👉 Click Here |

| 🥉 Kaje Forex | ✅Yes | $50 USD | 👉 Click Here |

| 🏅 Skilling | ✅Yes | $30 USD | 👉 Click Here |

| 🎖️ AVFX | ✅Yes | $50 USD | 👉 Click Here |

| 🏆 Windsor Brokers | ✅Yes | $30 USD | 👉 Click Here |

| 🥇 Tickmill | ✅Yes | $30 USD | 👉 Click Here |

| 🥈 Templer FX | ✅Yes | $1000 USD | 👉 Click Here |

| 🥉 InstaForex | ✅Yes | $1000 USD | 👉 Click Here |

| 🏅 ForexChief | ✅Yes | $100 USD | 👉 Click Here |

| 🎖️ Baxia Markets | ✅Yes | $30 USD | 👉 Click Here |

11 Best No-Deposit Bonus Forex Brokers (2024)

- ☑️ XM – Overall, the Best No-Deposit Bonus Forex Broker

- ☑️ JustMarkets – $30 Welcome Bonus for 1st-time traders

- ☑️ Kaje Forex – Multiple Forex Options + a $30 Welcome Bonus

- ☑️ Skilling – Recommended for Beginner Traders

- ☑️ AVFX – USD 50 No-Deposit Sign-Up Bonus Offer

- ☑️ Windsor Brokers – Simple No-Deposit Bonus Claim

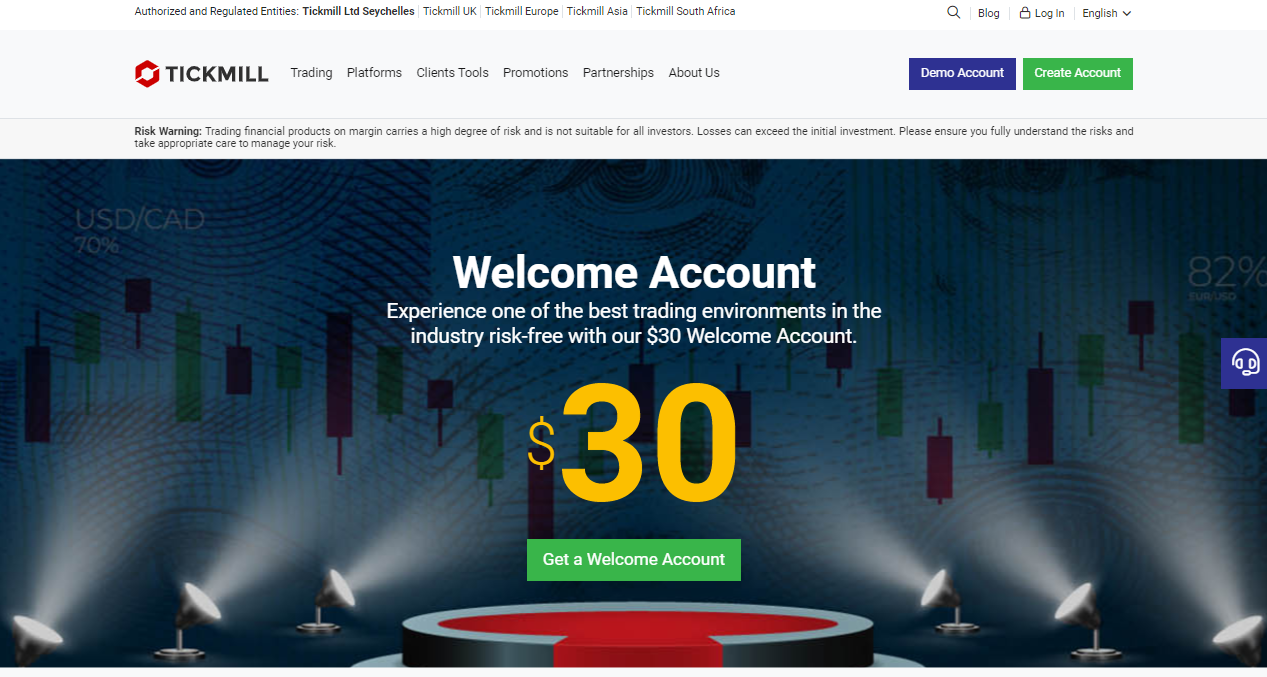

- ☑️ Tickmill – Award-Winning Broker

- ☑️ Templer FX – Low Spread No Deposit Bonus

- ☑️ InstaForex – Highest No Deposit Bonus Offer

- ☑️ ForexChief – Multiple Contests and Bonus Options

- ☑️ Baxia Markets – Maximum Bonus amount per customer of $500

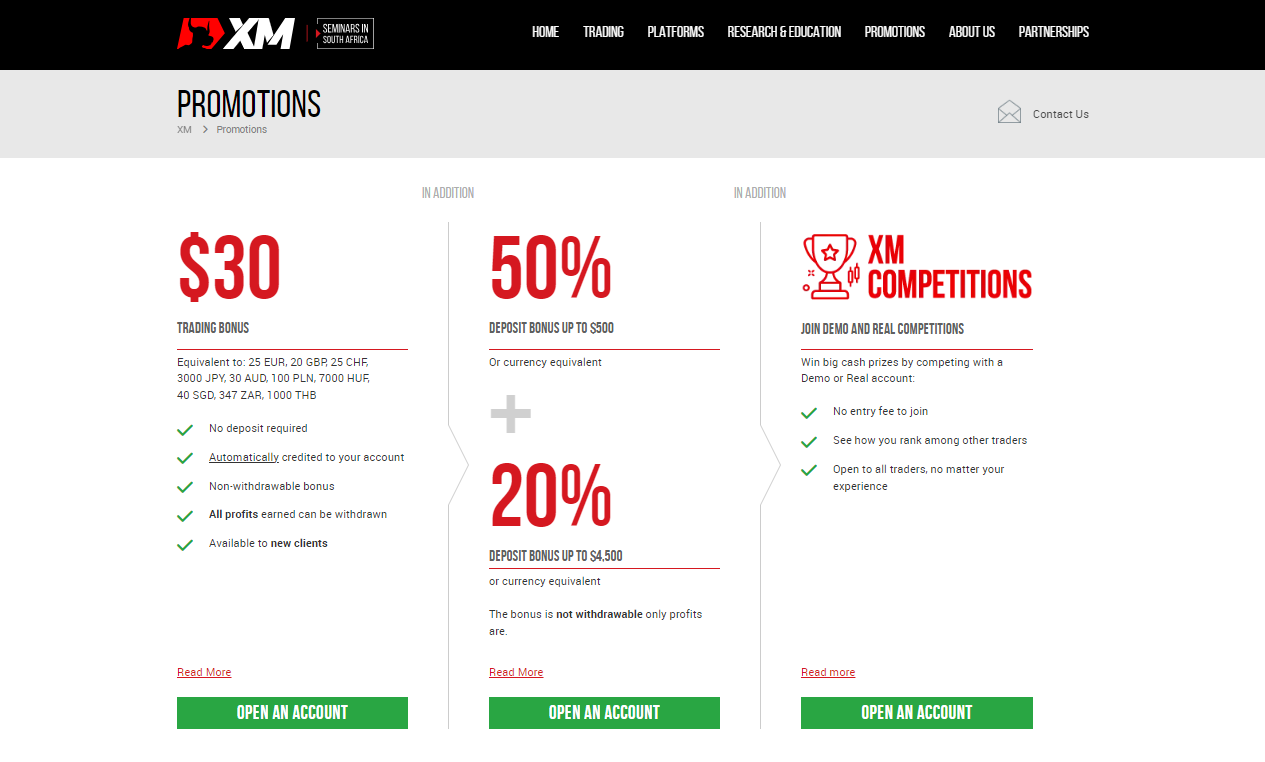

XM

XM, a reputable forex broker, offers a $30 no-deposit incentive for novice traders to test real-money trading without risking their own money. While bonus gains can be withdrawn, traders should read XM’s terms and conditions carefully, as limits may apply.

| 🎁 No-Deposit Bonus Amount | 30 USD |

| 🥳 Eligibility | Newly registered and verified real accounts |

| 🪅 Eligible Account for a sign-up bonus | XM Micro Account, XM Standard Account, XM Ultra-Low Account, XM Shares Account |

| 🎉 Sign-up bonus withdrawal eligibility | Only profits can be withdrawn |

| 🎊 Sign-up bonus expiry | 30 days after account verification |

The Pros of choosing XM as a No-Deposit Forex Broker will include:

✅ Before they commit capital, traders can try out XM’s platforms (MT4/MT5) and features.

✅ The incentive allows traders access to real markets without depositing money, which reduces initial financial risk.

Traders can access real market situations and get significant experience.

The Cons of choosing XM as a No-Deposit Forex Broker may include:

✅ The incentive normally has a validity period, and traders must utilize it within that duration.

Market volatility increases the danger of losing the bonus funds.

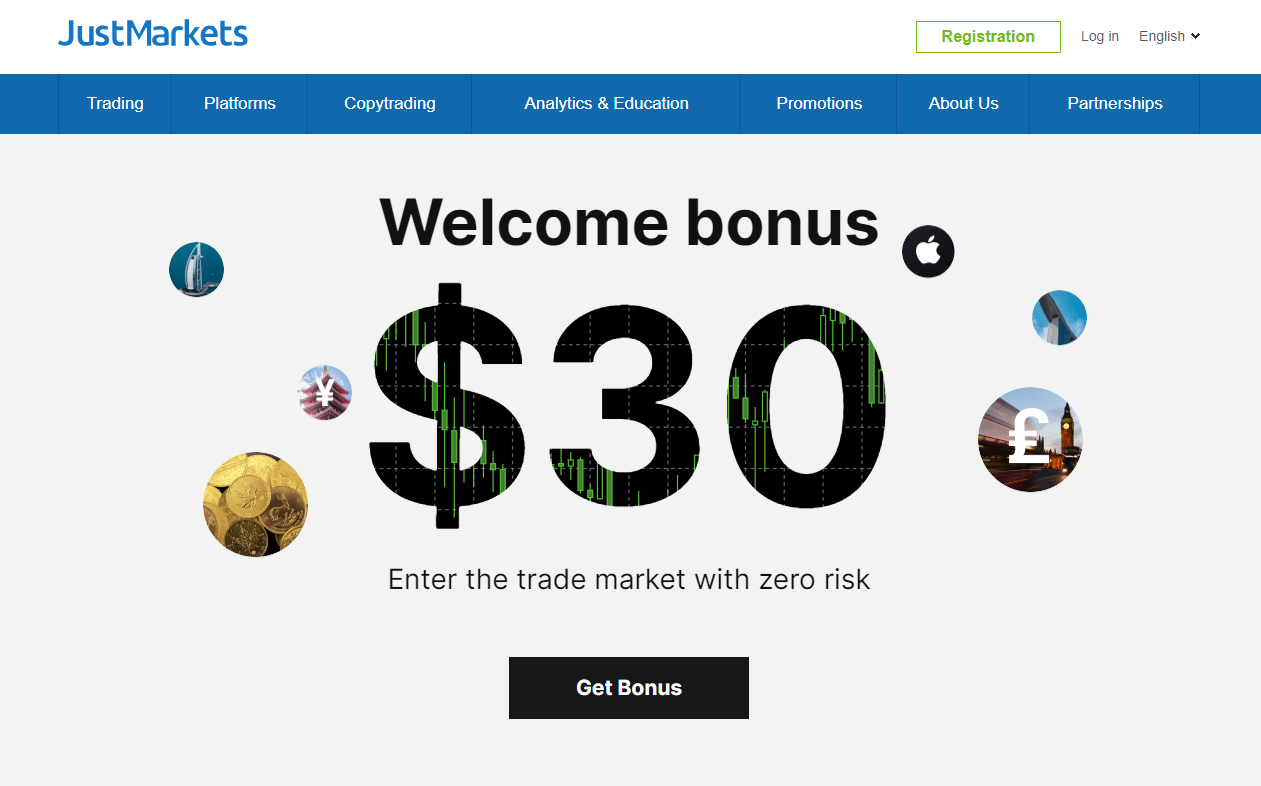

JustMarkets

JustMarkets offers new traders a $30 welcome bonus, allowing them to try live forex trading without financial risk. They can withdraw their bonus gains by creating a “Welcome Account” and meeting the 5 lots minimum requirement within 30 days.

| 🎁 Bonus Amount | $30 |

| 🥳 Applicable Account | Welcome Account |

| 🪅 Withdrawal Conditions | Only Profits can be withdrawn |

| 🎉 Eligible Trading Instruments | Forex, Metals |

| 🎊 Minimum Order Volume | 0.01 lot |

| 🍾 Maximum Open Positions | 5 lots |

| 💝 Are EAs allowed with the Sign-Up Bonus | None |

The Pros of choosing JustMarkets as a No-Deposit Forex Broker will include:

✅ Practice genuine forex trading without investing any of your own money.

✅ Gain practical experience navigating live market situations.

✅ After satisfying the trading conditions, you can withdraw your earned gains.

Ideal for novices who want to try their techniques and learn about Forex

The Cons of choosing JustMarkets as a No-Deposit Forex Broker may include:

✅ The bonus and earnings will expire in 30 days.

✅ You must trade at least 5 lots, which may be challenging for absolute novices.

✅ Each trade must generate a minimum profit of 6 pips to contribute to trading volume.

Not all earnings may be withdrawable.

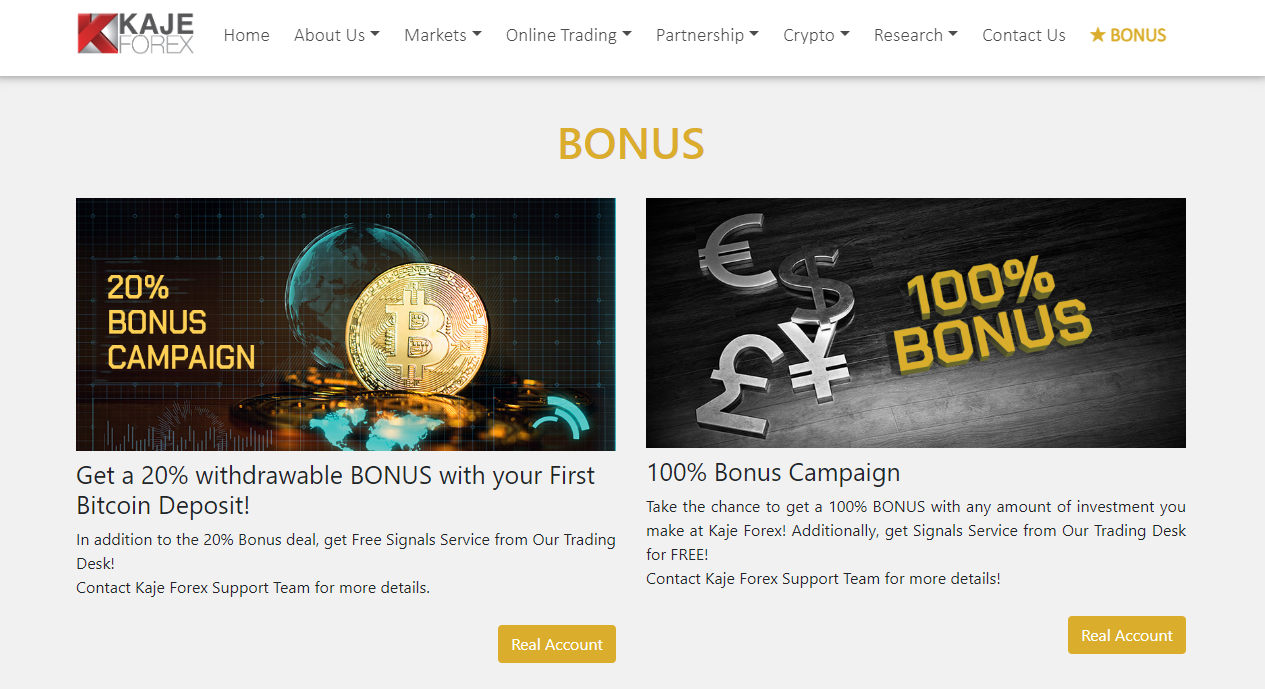

Kaje Forex

Kaje Forex offers new traders a $50 no-deposit incentive, but caution is needed as this unlicensed broker from the Marshall Islands carries more risk than reputable financial agencies. Thorough scrutiny is essential before investing funds, especially considering their regulatory status.

| 🎁 Bonus Amount | 50$ No Deposit Welcome Bonus |

| 🥳 Leverage | Trading with 1:400 leverage |

| 🪅 Registration | Register a New Trading account |

| 🎉 Eligibility | The Bonus is only available for new clients |

| 🎊 Trading Requirement | Need to trade 1 standard lot on Forex Instruments |

| 🍾 Profit Requirement | Profits should be up to $100 |

| 💝 Withdrawal Limit | More than $50 profits can be withdrawn at one time |

| 🎁 Maximum Withdrawal | Can withdraw a maximum of $500 from your bonus account |

| 🎀 Bonus Cancellation | The Bonus will be canceled after any withdrawal |

The Pros of choosing Kaje Forex as a No-Deposit Forex Broker will include:

✅ KYC and bank account verification for withdrawals strengthen trade security and discourage fraud.

✅ This offer lets traders test Kaje Forex’s platform and procedures in real market conditions without investing.

✅ The main benefit is trading without risking personal funds.

Although no investment is needed, traders can produce revenue that can be withdrawn under certain conditions.

The Cons of choosing Kaje Forex as a No-Deposit Forex Broker may include:

✅ Traders might be deterred by withdrawal limitations, including KYC verification and a $50 bank account wire transfer.

✅ The bonus is removed after any withdrawal, which could deter traders from trading with Kaje Forex.

✅ Beginners might struggle to trade one standard lot on Forex instruments for withdrawal eligibility.

✅ Profits are limited to $500 from the bonus account, limiting earnings.

The initial $50 bonus is deducted upon the first withdrawal, which may frustrate traders.

Skilling

Starting forex trading is easier with Skilling’s $30 no-deposit welcome bonus, offering an exceptional entry point for novice traders.

This opportunity allows them to gain experience and potentially earn profits without risking their funds. Nonetheless, it should be noted that withdrawing earnings from the bonus must comply with specific conditions.

| 🎁 Promoter | Skilling (Seychelles) Limited, regulated by the FSA in Seychelles |

| 🥳 Eligibility | New clients from a Designated Country outside the EU/EEA or clients without real money trades with Skilling |

| 🪅 Promotion Start Date | 07 November 2022 |

| 🎉 Bonus Credit | $30 |

| 🎊 Bonus Validity and Removal | Removed automatically if account equity falls below the bonus amount |

| 🍾 Transferability | Bonus and profits can be transferred between Skilling platforms |

| 💝 Withdrawal of Funds | Withdrawal requests may lead to bonus removal if the balance is less than the credited bonus |

| 🎁 Discretion of Bonus Award | Skilling has sole discretion in awarding the bonus and may withdraw if there is a suspected breach of Terms |

The Pros of choosing Skilling as a No-Deposit Forex Broker will include:

✅ The bonus and earnings can be transferred across Skilling’s other trading platforms.

✅ Clients can participate in this deal while taking advantage of Skilling’s other ongoing promotions.

✅ The bonus can be credited instantly, allowing traders to begin trading without waiting.

✅ Offers new clients a risk-free start to live trading without depositing personal funds.

It serves as an introduction to Skilling’s trading environment, which is especially useful for novices.

The Cons of choosing Skilling as a No-Deposit Forex Broker may include:

✅ The incentive is not accessible to European Union/EEA inhabitants.

✅ The $30 bonus cannot be withdrawn and is intended for trading.

✅ The promotion is only offered to new clients from specific countries and does not apply to current clients who have made real money trades.

Skilling may eliminate the incentive if a withdrawal request reduces the account balance below the bonus amount.

AVFX Capital

AVFX Capital provides a $50 Welcome Bonus for new and existing clients to trade without a deposit. Users must create a bonus account, validate email, and trade 20 lots to withdraw winnings within 30 days.

| 🎁 Promotion Eligibility | Both new and current AVFX clients apply |

| 🥳 Promotion Flow | They must trade at least 20 lots within 30 days to withdraw any profits earned |

| 🪅 Promotion Period and Withdrawal | Clients have 30 calendar days to complete the conditions and can manually withdraw their non-zero profit if conditions are met |

| 🎉 Account Closure | The promo account will close automatically on the 31st day |

| 🎊 Profit Withdrawal Conditions | Only orders with a 10 pip (100 points) difference between opening and closing prices qualify |

The Pros of choosing AVFX Capital as a No-Deposit Forex Broker will include:

✅ Traders may gain experience in the actual market without risking their assets.

✅ Opening a Welcome Bonus account is simple, requiring simple email verification.

✅ The incentive is offered to new and current clients, ensuring flexibility and inclusion.

The $50 incentive gives additional funds for new traders to get started without a deposit.

The Cons of choosing AVFX Capital as a No-Deposit Forex Broker may include:

✅ The Welcome Bonus account can only be used once per client, restricting the ability to test alternative trading methods using the bonus.

✅ Profits can only be withdrawn if the trade’s initial and ending prices differ by at least 10 pip.

✅ The bonus profit is only transferred to an AVFX genuine active trading account and is limited to the first $50 bonus.

✅ There is a maximum of five simultaneous positions, which may restrict trading methods.

The maximum profit that may be withdrawn is $50, which limits the earning possibilities.

Windsor Brokers

Windsor Brokers offers a $30 no-deposit incentive for new Prime Account holders aged 18 and older, valid for six months unless the account is dormant or withdrawn.

Profits can only be withdrawn if they exceed $60, have at least one closed lot, and have been traded 20 times. Limited to one household and not available in some countries.

| 🎁 Eligible Accounts | New live account holders of Prime Accounts with currency base in US$, EUR €, GBP £, JPY ¥ |

| 🥳 Credit Nature | $30 credited in the form of non-withdrawable, non-transferable trading credit |

| 🪅 Credit Validity | Valid for 6 months from the date of credit |

| 🎉 Withdrawal Conditions | Profits can only be withdrawn if they are equal to or higher than $60, closed lots reach 1, and transactions amount to 20 trades or above |

| 🎊 One Account Rule | Only one $30 Free Account is permitted per household. |

The Pros of choosing Windsor Brokers as a No-Deposit Forex Broker will include:

✅ Offers new traders $30 in trading credit, allowing them to trade without making an initial deposit.

✅ Profits can be withdrawn when they exceed $60 and fulfill the trading volume restrictions.

✅ The trading credit has a six-month validity term, giving traders plenty of opportunity to use the bonus.

Available for Prime Accounts with various currency bases, allowing traders greater options.

The Cons of choosing Windsor Brokers as a No-Deposit Forex Broker may include:

✅ The $30 credit cannot be withdrawn; traders may only take winnings under specified conditions.

✅ Profits are only withdrawable at double the bonus amount or more, which may be difficult for beginning traders.

✅ The bonus and any winnings are forfeited if the account is inactive for more than 30 days during the validity period.

A specified trading volume and several deals must be completed before gains may be withdrawn.

Tickmill

Tickmill provides non-EU traders a $30 Welcome Account, allowing them to explore its Pro Account without risking money.

This exclusive account offers customizable leverage options and a bonus $30 credit. Profits can be claimed within two weeks after 60 days of registration. However, bonuses may be forfeited or accounts suspended due to abuse.

| 🎁 Maximum trading credit | $30 |

| 🥳 Validity Period | 60 days after registration |

| 🪅 Withdrawal timeframe | 14 days |

| 🎉 Minimum Withdrawable Profit | $30 |

| 🎊 Maximum Withdrawal Profit | $100 |

| 🍾 Minimum Deposit to withdraw profit | $100 |

| 💝 Account Conditions | Same as the Pro Account |

The Pros of choosing Tickmill as a No-Deposit Forex Broker will include:

✅ The Welcome Account mirrors the Pro Account requirements.

✅ Traders can withdraw gains (between $30 and $100).

✅ New clients can begin trading without making an initial deposit, removing the danger of losing personal assets.

Like the Pro Account, the Welcome Account lets traders change leverage and send profits straight to their Tickmill Wallet.

The Cons of choosing Tickmill as a No-Deposit Forex Broker may include:

✅ Profits can be taken up to a maximum of $100.

✅ Profits can be withdrawn after making a minimum deposit of $100 to the Tickmill Wallet.

✅ The account and its money are only valid for a limited time (60 days for trading and another 14 days to recover earnings).

✅ Tickmill has strict guidelines to avoid abuse, which might result in bonus cancellation or account blocking if not followed.

✅ The first incentive of $30 cannot be withdrawn or transferred.

This deal is not available to EU citizens, which limits its availability.

Templer FX

Templer FX offers new traders a $1,000 no-deposit bonus, providing them with substantial starting capital without any financial commitment. This program allows participants to experience forex trading in real market conditions, offering a unique opportunity for learning and potential profit.

| 🎁 Eligibility | New clients who have not previously registered in the Members area |

| 🥳 Bonus Request | Must be requested through the Members area after registration and verification |

| 🪅 Bonus Amount | A fixed sum of $30 credited as No Deposit Bonus |

| 🎉 Withdrawal Conditions | A trading volume of 5 lots is required for the withdrawal of bonuses and profits |

| 🎊 Bonus Validity | Bonus funds are available for 30 calendar days after activation. If conditions are not met within this period, the bonus is cancelled |

The Pros of choosing Templer FX as a No-Deposit Forex Broker will include:

✅ After meeting certain standards, traders can withdraw bonus winnings, encouraging good trading.

✅ TemplerFX’s $30 no-deposit incentive attracts new traders.

✅ The bonus lets traders test TemplerFX’s platform in real-market conditions without risking their own money.

Certain restrictions exist, but the incentive is offered to many countries, offering a worldwide opportunity.

The Cons of choosing Templer FX as a No-Deposit Forex Broker may include:

✅ Beginning traders will find it difficult to withdraw the bonus and earnings after trading 5 lots.

✅ The minimum deposit to withdraw gains is $10, which can deter traders who desire to trade without investing.

✅ TemplerFX might cancel the bonus and trading results if fraud is discovered, raising uncertainty.

✅ The $30 incentive expires after 30 days if the trading conditions are unmet.

The bonus account’s $100 profit withdrawal restriction can limit successful traders’ winnings.

InstaForex

InstaForex offers new traders a $1,000 no-deposit bonus, providing substantial starting capital without an initial deposit. This allows traders to explore the forex market, test the platform, and develop real-world trading techniques.

| 🎁 Eligibility | Available to new clients with USD accounts opened from 29/03/2019, excluding MT5 accounts |

| 🥳 Withdrawal Conditions | Profits gained from trading the bonus funds can be withdrawn if all terms are fulfilled |

| 🪅 Deposit Requirement | Bonus canceled in full once the account is deposited with real money. |

| 🎉 Profit Conversion | Profit gained is converted into a bonus worth 100% of the deposit amount if the account is replenished within 7 days after receiving the StartUp Bonus |

The Pros of choosing InstaForex as a No-Deposit Forex Broker will include:

✅ Allows new traders to trade without deposit, decreasing entrance barriers.

✅ Allows bonus winners to withdraw earnings, encouraging successful trading.

✅ Traders can experience real-market trading without jeopardizing their own money.

✅ Deposit actual dollars to convert bonus profit into a marketable bonus.

✅ Open several accounts and earn a 30% Welcome Bonus for each deposit.

Bonus lets you imitate trades and learn from professional traders.

The Cons of choosing InstaForex as a No-Deposit Forex Broker may include:

✅ The bonus is not withdrawable. However, earnings can be with tight restrictions.

✅ The withdrawal conditions are complex.

✅ If no deposit is made within 7 days, the account becomes a demo, and funds become virtual.

For profit conversion and withdrawal, a deposit is required within 7 days.

ForexChief

ForexChief offers a no-deposit incentive for new traders to start trading without an initial commitment, allowing them to simulate real-market trading scenarios and test methods without risking personal assets. However, certain restrictions and conditions must be followed.

| 🎁 Bonus Amount | $100 No-Deposit Bonus |

| 🥳 Verification Process | Quick verification is required to receive the bonus |

| 🪅 Application Requirement | The bonus is credited automatically in the ForexChief mobile app after verification |

| 🎉 Time Limit | No time limit to use the No-Deposit Bonus |

| 🎊 Withdrawal Conditions | $100 can be withdrawn with no restrictions upon completing the required turnover. |

The Pros of choosing ForexChief as a No-Deposit Forex Broker will include:

✅ Traders can earn up to $100 after achieving the turnover criterion, rewarding effective trading.

✅ All trading techniques and machines are allowed, giving traders flexibility.

✅ No expiration date lets traders use the incentive at their speed.

✅ Trading without depositing personal funds lowers the financial barrier to entry.

Trading is rapid, with the $100 bonus quickly credited following verification.

The Cons of choosing ForexChief as a No-Deposit Forex Broker may include:

✅ One bonus can be claimed, and numerous or close associate claims are prohibited.

✅ ForexChief might revoke the bonus and earnings without explanation, putting traders who rely on it for funds at risk.

✅ The $10,000,000 trading turnover requirement for profit withdrawal may be too high for certain traders.

✅ After turnover, only $100 of profit can be withdrawn, restricting financial benefit.

The incentive is unavailable to traders in some countries, restricting worldwide access.

Baxia Markets

Baxia Markets offers new clients a $30 Welcome Bonus, allowing them to trade assets like FOREX, commodities, energy, indexes, and digital markets on various platforms. Regulatory by the FSA and SCB, it offers no deposit fees.

| 🎁 Bonus Amount | $30 Welcome Bonus Account |

| 🥳 Platform Availability | Trade on forex, metals, energies, indices, and cryptocurrencies using MT5, Web, Android, and iOS platforms |

| 🪅 Bonus Claim Process | Bonus automatically credited after account verification and minimum deposit of $50 |

The Pros of choosing Baxia Markets as a No-Deposit Forex Broker will include:

✅ Lowers entrance barriers by offering new traders a $30 incentive to trade without a deposit.

Forex, metals, energy, indices, and digital markets can be traded with the bonus of a diversified experience.

The Cons of choosing Baxia Markets as a No-Deposit Forex Broker may include:

✅ The $30 bonus requires a $50 minimum deposit.

✅ Although not stated, bonuses usually have withdrawal terms.

✅ The $30 incentive might be limited for experienced traders making larger trades.

Trading using bonus funds does not reduce financial market risk.

What is a No-Deposit Bonus?

Forex brokers offer a no-deposit bonus to new clients as a promotional incentive, allowing them to start trading without an initial deposit. This type of reward is designed to attract beginners by providing free capital for transactions on the forex market.

Furthermore, traders can test real-life scenarios, evaluate broker platforms, and potentially earn profits without risking their funds.

While this presents an excellent opportunity for early-stage traders, they must fully comprehend any terms and limitations surrounding these incentives to maximize benefits.

In Conclusion

In our opinion, No-deposit forex brokers present an appealing gateway for beginners to enter the forex market without financial risk, offering a unique opportunity to experience real trading conditions, test strategies, and familiarize themselves with trading platforms.

These bonuses can be a valuable educational tool, enhancing traders’ knowledge and confidence. However, the inherent restrictions and often stringent withdrawal conditions attached to these bonuses limit their practical utility in terms of profit-making potential.

While the concept undeniably provides a risk-free introduction to forex trading, traders should remain cautious and thoroughly understand the terms and conditions, ensuring that their trading journey is both educational and potentially profitable in the long run.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all South African investors. Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Frequently Asked Questions

What is a no-deposit forex bonus?

A no-deposit forex bonus is an amount of money the broker adds to your trading account, allowing you to begin trading without depositing your funds. These bonuses are intended to entice novice traders and allow them to test out a platform risk-free.

How do I get a no-deposit forex bonus?

Usually, you must create a live trading account with a broker that offers a no-deposit bonus. The broker can impose extra restrictions, such as validating your identification.

Can I withdraw profits made from a no-deposit bonus?

Yes, but there are usually conditions. Before withdrawing bonus winnings, you may need to meet a trading volume requirement or make a modest investment.

Are no-deposit brokers legitimate?

Some no-deposit brokers are trustworthy, while others can be less so. Before joining up, always conduct extensive research on the broker, verify for regulatory compliance, and read reviews.

What are the risks of using a no-deposit bonus?

No-deposit bonuses can be a great way to get started, but they sometimes include limits on trading and withdrawals. Before taking a bonus, fully grasp the terms and restrictions.

Are there any downsides to no-deposit bonuses?

No-deposit incentives may have wider spreads or less favorable trading conditions than normal accounts. Furthermore, the focus on withdrawing the bonus may detract from creating a strong trading strategy.

How do I find reputable no-deposit forex brokers?

Conduct internet research, compare brokers, and focus on well-regulated organizations. Look for websites that review forex brokers and pay attention to real customer reviews.