The 6 Best ECN Forex Brokers

Last Update: March 16th, 2024

The 6 Best ECN Forex Brokers revealed. We have explored and tested several prominent Forex brokers to identify the Top 6 Broker Choices.

In this in-depth guide you’ll learn:

- The Best ECN Forex Brokers – a List

- The Best ECN Forex Brokers with MT4 and MT5

- The Best Low Spread ECN Forex Broker

- Who is the Best ECN Broker?

- Regualted, True ECN Forex Brokers for Beginners

and much, MUCH more!

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | SFSA, FSCA, CySec* | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | Not Regulated | 0.001 BTC | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | CySEC,MISA, FSCA | USD 20 | Visit Broker >> |

The 6 Best ECN Forex Brokers – a Comparison

| 🔎 Broker | 💹 ECN Broker | 💶 Min. Deposit | 🚀 Open an Account |

| 🥇 FXTM | ✅Yes | $5 USD | 👉 Click Here |

| 🥈 FP Markets | ✅Yes | $100 USD | 👉 Click Here |

| 🥉 IC Markets | ✅Yes | $200 USD | 👉 Click Here |

| 🏅 RoboForex | ✅Yes | $10 USD | 👉 Click Here |

| 🎖️ FBS | ✅Yes | $100 USD | 👉 Click Here |

| 🥇 Dukascopy | ✅Yes | $100 USD | 👉 Click Here |

The 6 Best ECN Forex Brokers (2024)

- ☑️ FXTM – Overall, the Best ECN Forex Broker

- ☑️ FP Markets – Best ECN Broker for Scalping

- ☑️ IC Markets – Popular ECN Broker for Beginners

- ☑️ RoboForex – Best ECN Broker for Pro Traders

- ☑️ FBS – ECN Account with Negative Spreads

- ☑️ Dukascopy – Trusted, Regulated Broker Choice

FXTM

FXTM is a globally recognized Forex broker renowned for its diverse range of trading products and cutting-edge technological solutions.

FXTM offers ECN (Electronic Communication Network) trading, facilitating direct access to interbank liquidity pools, ensuring fast execution and competitive pricing.

With ECN trading, FXTM clients can benefit from deep liquidity, narrow spreads, and transparent pricing, enhancing their trading experience.

FXTM provides various account types tailored to meet the needs of different traders, including Standard, ECN, and ECN Zero accounts. Each account type offers distinct features and benefits, catering to traders of all levels, from beginners to experienced professionals.

Spreads on FXTM’s ECN accounts are typically low and variable, starting from as low as 0.1 pips, depending on market conditions. This allows traders to execute their strategies efficiently and effectively.

Regulated by multiple authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC), FXTM ensures a secure and trustworthy trading environment for its clients, adhering to stringent regulatory standards. FXTM has a trust score of 93%.

| 🔎 Broker | 🥇 FXTM |

| 📈 Established Year | 2011 |

| 📉 Regulation and Licenses | CySEC, FSCA, FCA, CMA, FSC Mauritius |

| 📊 Ease of Use Rating | 5/5 |

| 🎁 Bonuses | Referral bonus |

| ⏰ Support Hours | 24/5 |

| 🖱️ Trading Platforms | MetaTrader 4, MetaTrader 5, FXTM Trader |

| 📌 Account Types | Micro, Advantage, Advantage Plus |

| 📍 Base Currencies | USD, EUR, GBP, NGN |

| 💹 Spreads | 0.0 pips |

| 💱 Leverage | 1:2000 |

| 🪙 Currency Pairs | 60; major, minor, exotic pairs |

| 💴 Minimum Deposit | 10 USD |

| 💵 Inactivity Fee | $5 after 6 months of inactivity |

| 📈 Website Languages | English, Arabic, Chinese (Simplified), Chinese (Traditional), Czech, French, Hindi, Indonesian, Polish, Spanish, Italian, Korean, Malay, Russian, Thai, Vietnamese, Persian, Urdu |

| 📉 Fees and Commissions | Spreads from 0.0 pips, commissions between $0.40 and $2, depending on the trading volume |

| 🤝 Affiliate Program | ✅Yes |

| ❌ Banned Countries | The United States, Mauritius, Japan, Canada, Haiti, Suriname, the Democratic Republic of Korea, Puerto Rico, Brazil, the Occupied Area of Cyprus, Hong Kong |

| 🅰️ Scalping | ✅Yes |

| 🅱️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, Forex Indices, Spot Metals, CFD Kenya Stocks, Kenya Stocks, CFD US Stocks, US Stocks, Hong Kong Stocks, CFD EU Stocks, Spot Commodities, Spot Indices, Stock Baskets, Crypto CFDs |

| 🚀 Open an Account | 👉 Click Here |

The Pros of Trading with FXTM will include:

✅ Only concentrates on trading CFDs.

✅ High fees for withdrawals from banks.

✅ There is a smaller selection of tradable marketplaces in the product portfolios of other brokers.

✅ Average price compared to other brokers.

✅ Prices for buy order swaps are greater than those at comparable brokers.

Slippage occurs even with the rapid execution.

The Cons of Trading with FXTM may include:

✅ The extensive feature set may be daunting to novices, and it could take some time to fully understand the platform.

✅ FXTM may offer a limited variety of cryptocurrencies as compared to dedicated cryptocurrency exchanges.

✅ To ensure the platform meets all standards, it is advisable for traders to verify that FXTM conforms with local rules.

✅ The availability of certain marketplaces or financial products may be restricted in contrast to other brokers.

Even though FXTM offers educational materials, users may find that the information is not as thorough as they would want, and having more resources could facilitate learning.

FP Markets

FP Markets is a leading Forex broker known for its comprehensive range of trading solutions and advanced technology. The broker offers ECN (Electronic Communication Network) trading, providing traders with direct access to liquidity providers and interbank markets.

With FP Markets’ ECN model, traders benefit from ultra-fast execution, deep liquidity, and competitive pricing, enabling them to execute trades with minimal slippage and tight spreads.

Regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), FP Markets ensures a secure and transparent trading environment for its clients.

FP Markets offers a variety of trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), renowned for their user-friendly interfaces and comprehensive trading tools.

Spreads on FP Markets’ ECN accounts are typically low and competitive, starting from as low as 0.0 pips, depending on market conditions. This allows traders to optimize their trading strategies and maximize their potential profits. FP Markets has a high trust score of 87%.

| 🔎 Broker | 🥇 FP Markets |

| 📈 Established Year | 2005 |

| 📉 Regulation and Licenses | ASIC, CySEC, FSCA, FSA, FSC |

| 5️⃣ Ease of Use Rating | 4/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/7 |

| 📊 Trading Platforms | MetaTrader 4, MetaTrader 5, IRESS, cTrader, FP Markets App |

| ↪️ Account Types | Standard, Raw, Islamic Standard, Islamic Raw |

| 🪙 Base Currencies | AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, USD, SGD |

| 📌 Spreads | From 0.0 pips |

| 📍 Leverage | 1:500 |

| 💴 Currency Pairs | Major, Minor, Exotic |

| 💵 Minimum Deposit | AU$100 |

| 💶 Inactivity Fee | None |

| 🥰 Website Languages | English, Arabic, German, Portuguese, Vietnamese, Indonesian, French, Malay, Italian, Russian |

| 💷 Fees and Commissions | Spreads from 0.0 pips, commissions from US$3 per side |

| 🤝 Affiliate Program | ✅Yes |

| ❌ Banned Countries | United States, Japan, New Zealand |

| 🅰️ Scalping | ✅Yes |

| 🅱️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, Shares, Metals, Commodities, Indices, Cryptocurrencies, Energies, ETFs, Bonds |

| 🚀 Open an Account | 👉 Click Here |

The Pros of Trading with FP Markets will include:

✅ FP Markets’ state-of-the-art technological infrastructure benefits traders.

✅ Traders can benefit from extensive customer service offered by a knowledgeable and dedicated team.

✅ Trading with a broker who is governed by a number of international regulatory organizations, such as the FSA, FSC, ASIC, FSCA, and CySEC, is one alternative available to traders.

✅ FP Markets offers a full range of instructional resources for traders who want to improve their trading skills.

✅ FP Markets provides a variety of account types to meet the various needs and trading preferences of its traders.

✅ Trading systems such as MetaTrader 4, cTrader, IRESS, and MetaTrader 5 provide traders with advanced analytical and charting capabilities.

✅ With access to a wide variety of international markets via FP Markets, traders can diversify their trading strategies across asset classes.

FP Markets continues to offer competitive spreads and minimum commission policies.

The Cons of Trading with FP Markets may include:

✅ Due to FP Markets’ worldwide focus, there may not be as much support for all local payment options.

✅ Even if FP Markets provides a large selection of products, some traders could be interested in niche or local markets that they do not.

FP Markets charges withdrawal fees for a variety of payment methods.

IC Markets

IC Markets stands out as a premier Forex broker renowned for its ECN (Electronic Communication Network) trading environment, providing traders with direct access to interbank liquidity and institutional-grade pricing.

With IC Markets’ ECN model, traders enjoy lightning-fast execution speeds, minimal slippage, and tight spreads, enhancing their trading experience.

The broker offers a diverse selection of assets, including currency pairs, commodities, indices, and cryptocurrencies, catering to the varied needs and preferences of traders worldwide.

Regulated by the Australian Securities and Investments Commission (ASIC), IC Markets ensures a secure and trustworthy trading environment, adhering to strict regulatory standards.

IC Markets boasts exemplary customer support, offering multilingual assistance via various channels, including live chat, email, and phone support.

The broker’s dedicated support team is available 24/5 to assist clients with any queries or issues they may encounter, providing prompt and professional assistance to ensure a seamless trading experience. IC Markets has a high trust score of 87%.

| 🔎 Broker | 🥇 IC Markets |

| 📈 Established Year | 2007 |

| 📉 Regulation and Licenses | ASIC, CySEC, FSA, SCB |

| 📊 Ease of Use Rating | 5/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/7 |

| 🖱️ Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, IC Social, Signal Start, ZuluTrade |

| 📌 Account Types | cTrader, Raw Spread, Standard |

| 🪙 Base Currencies | AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD |

| 💹 Spreads | From 0.0 pips EUR/USD (Raw Spread Account) |

| 💱 Leverage | 1:500 |

| 💴 Currency Pairs | 64+ |

| 💵 Minimum Deposit | 200 USD |

| 💶 Inactivity Fee | None |

| 🥰 Website Languages | English, Spanish, Russian, Thai, Malay, Vietnamese, Italian, Portuguese, and several others |

| 💷 Fees and Commissions | Spreads from 0.0 pips, commissions from $3.5 |

| 🤝 Affiliate Program | ✅Yes |

| ❌ Banned Countries | United States, Canada, Iran, Yemen, and OFAC countries |

| 📈 Scalping | ✅Yes |

| 📉 Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, Commodities, Indices, Bonds, Cryptocurrencies, Stocks, Futures |

| 🚀 Open an Account | 👉 Click Here |

The Pros of Trading with IC Markets will include:

✅ Social trading platforms like ZuluTrade and IC Social are supported by IC Markets.

✅ The stringent regulatory framework of IC Markets, which is supervised by authorities like ASIC and CySEC, offers a safe trading environment.

✅ For traders who want swap-free accounts due to religious beliefs, IC Markets offers Islamic accounts.

✅ Trade holdings can be increased by traders using high leverage (up to 1:1000).

✅ Transparent trading conditions and charge schedules are provided by IC Markets.

✅ The competitive pricing is made possible by IC Markets’ cooperation with several sources of liquidity.

✅ When the market is not doing well, IC Markets provides Protection Against Negative Balance

✅ Traders who need continuous market access benefit from IC Markets’ continuous server uptime.

The no-dealing-desk (NDD) model offered by IC Markets helps traders by removing any potential conflicts of interest.

The Cons of Trading with IC Markets may include:

✅ Compared to other brokers, the minimum deposit of $200 is significantly higher.

Novice traders could be intimidated by the abundance of trading tools and sophisticated features.

RoboForex

RoboForex is a prominent Forex broker known for its innovative trading solutions and diverse range of financial instruments.

RoboForex offers ECN (Electronic Communication Network) trading, providing traders with direct access to liquidity providers and interbank markets. With RoboForex’s ECN model, traders can enjoy fast execution, deep liquidity, and competitive pricing, enhancing their trading experience.

The broker offers a variety of trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), renowned for their advanced charting tools, customizable indicators, and automated trading capabilities.

RoboForex boasts a comprehensive selection of assets, including currency pairs, commodities, indices, and cryptocurrencies, catering to the varied needs and preferences of traders worldwide.

Regulated by multiple authorities, including the International Financial Services Commission (IFSC) in Belize, RoboForex prioritizes security and transparency, ensuring a safe trading environment for its clients.

Additionally, RoboForex provides robust educational resources, market analysis, and responsive customer support, empowering traders with the knowledge and assistance needed to succeed in the financial markets. RoboForex has a high trust score of 87%.

| 🔎 Broker | 🥇 RoboForex |

| 📈 Established Year | 2009 |

| 📉 Regulation and Licenses | FSC |

| 5️⃣ Ease of Use Rating | 5/5 |

| 🎁 Bonuses | Yes, welcome bonus, up to 10% on account balance, cashback rebates |

| ⏰ Support Hours | 24/7 |

| 📊 Trading Platforms | MetaTrader 4, MetaTrader 5, R MobileTrader, R StocksTrader |

| 🖱️ Account Types | Prime, ECN, R StocksTrader, ProCent, Pro |

| 🪙 Base Currencies | USD, EUR |

| 📌 Spreads | From 0.0 pips |

| 📍 Leverage | 1:2000 |

| 💴 Currency Pairs | 40; minor, major, and exotic pairs |

| 💵 Minimum Deposit | 10 USD |

| 💶 Inactivity Fee | None |

| 🥰 Website Languages | English, Polish, Indonesian, Malayan, Portuguese, Spanish, Italian, Czech, Simplified Chinese, Vietnamese, and more |

| 💷 Fees and Commissions | Spreads from 0.0 pips, commissions from 10 USD per million traded |

| 🤝 Affiliate Program | ✅Yes |

| ❌ Banned Countries | USA, Canada, Japan, Australia, Bonaire, Curaçao, the Democratic Republic of Timor-Leste, Liberia, Saipan, Russia, Sint Eustatius, Tahiti, Turkey, Guinea-Bissau, Micronesia, Northern Mariana Islands, Svalbard and Jan Mayen, South Sudan, and other regions |

| 📈 Scalping | ✅Yes |

| 📉 Hedging | ✅Yes |

| 📊 Trading Instruments | Forex, stocks, indices, ETFs, commodities, metals, energy commodities |

| 🚀 Open an Account | 👉 Click Here |

The Pros of Trading with RoboForex will include:

✅ RoboForex offers ECN (Electronic Communication Network) trading, providing direct access to liquidity providers and interbank markets, resulting in fast execution and competitive pricing.

✅ RoboForex provides a comprehensive selection of financial instruments, including currency pairs, commodities, indices, and cryptocurrencies, catering to diverse trading preferences.

✅ Traders can choose from various trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and RoboForex’s proprietary platform, offering flexibility and customization options.

✅ RoboForex is regulated by reputable authorities, including the International Financial Services Commission (IFSC) in Belize, ensuring a secure and trustworthy trading environment for clients.

RoboForex offers extensive educational materials, including webinars, tutorials, and market analysis, empowering traders with the knowledge and skills needed to succeed in the financial markets.

The Cons of Trading with RoboForex may include:

✅ While RoboForex is regulated by the IFSC in Belize, some traders may prefer brokers regulated by stricter authorities, such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC).

✅ RoboForex may charge withdrawal fees, depending on the withdrawal method and account type, which could impact traders’ overall profitability.

✅ Traders with dormant accounts may incur inactivity fees, which could be a concern for those who do not trade frequently.

✅ Some traders may find RoboForex’s customer support to be less responsive compared to other brokers, especially during peak trading hours or weekends.

While RoboForex offers a variety of trading platforms, traders may encounter compatibility issues or limitations with certain devices or operating systems, affecting their trading experience.

FBS

FBS is a prominent Forex broker recognized for its wide range of trading offerings and user-friendly platforms.

While FBS primarily operates as a market maker, it offers an ECN (Electronic Communication Network) trading account option, providing traders with access to direct market liquidity and competitive pricing.

With FBS’ ECN account, traders can benefit from fast execution, tight spreads, and transparent pricing, enhancing their trading experience.

The broker boasts a diverse selection of assets, including currency pairs, commodities, indices, and cryptocurrencies, catering to various trading preferences.

FBS provides multiple trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), equipped with advanced charting tools and customizable indicators.

FBS offers responsive customer support via live chat, email, and phone, assisting traders with any queries or issues they may encounter.

Additionally, FBS provides educational resources, market analysis, and trading tools to empower traders with the knowledge and tools needed to succeed in the financial markets. FBS has a trust score of 75%.

| 🔎 Broker | 🥇 FBS |

| 📈 Established Year | 2009 |

| 📉 Regulation and Licenses | IFSC, CySEC, ASIC, FSCA |

| 5️⃣ Ease of Use Rating | 4/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/7 |

| 📊 Trading Platforms | MetaTrader 4, MetaTrader 5, FBS Trader |

| 🖱️ Account Types | Retail, Demo, Islamic |

| 💴 Base Currencies | USD, EUR |

| 📌 Spreads | 0.7 pips |

| 📍 Leverage | 1:3000 |

| 💵 Currency Pairs | 71 |

| 💶 Minimum Deposit | 5 USD |

| 💷 Inactivity Fee | None |

| 🥰 Website Languages | English, German, Spanish, French, Italian, Portuguese, South African, Malay, Vietnamese, Turkish, Korean, and others |

| 💳 Fees and Commissions | Spreads from 0.7 pips, commission-free |

| 🤝 Affiliate Program | ✅Yes |

| ❌ Banned Countries | Japan, United States, Canada, United Kingdom, Myanmar, Brazil, Israel, the Islamic Republic of Iran |

| ⏩ Scalping | ✅Yes |

| ▶️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, Precious Metals, Indices, Energies, Stocks, Crypto CFDs |

| 🚀 Open an Account | 👉 Click Here |

The Pros of Trading with FBS will include:

✅ Typically, FBS provides a range of bonuses and special offers.

✅ FBS provides frequent market updates and analysis. Opening an account only requires a small deposit

✅ The trading platform can be used with automated trading methods.

✅ Traders can use local payment methods to deposit and withdraw money

✅ For 45 days, a demo account is offered.

✅ The MetaTrader platforms provide traders with tools and settings that allow them to customize their trading experience.

✅ Muslim traders can open a Swap-Free Account with FBS.

✅ The FBS website is easy to use.

Through a variety of communication channels, traders can reach FBS around-the-clock.

The Cons of Trading with FBS may include:

✅ FBS now only has one retail account, down from its prior number of accounts.

✅ Fees for withdrawals may apply based on the method of payment utilized.

✅ As a market maker, there can be a conflict of interest when executing trades.

✅ Not all countries may provide all FBS services and promos.

✅ FBS stopped offering CopyTrade in September. Although having a high leverage ratio might be helpful, it also raises the risk of suffering significant losses, particularly for novice traders.

✅ In reaction to notable market volatility or economic shocks, floating spreads may increase in size.

✅ For newcomers, the array of functions and intricate platforms may be daunting.

Compared to its rivals, FBS provides fewer comprehensive research tools and insights.

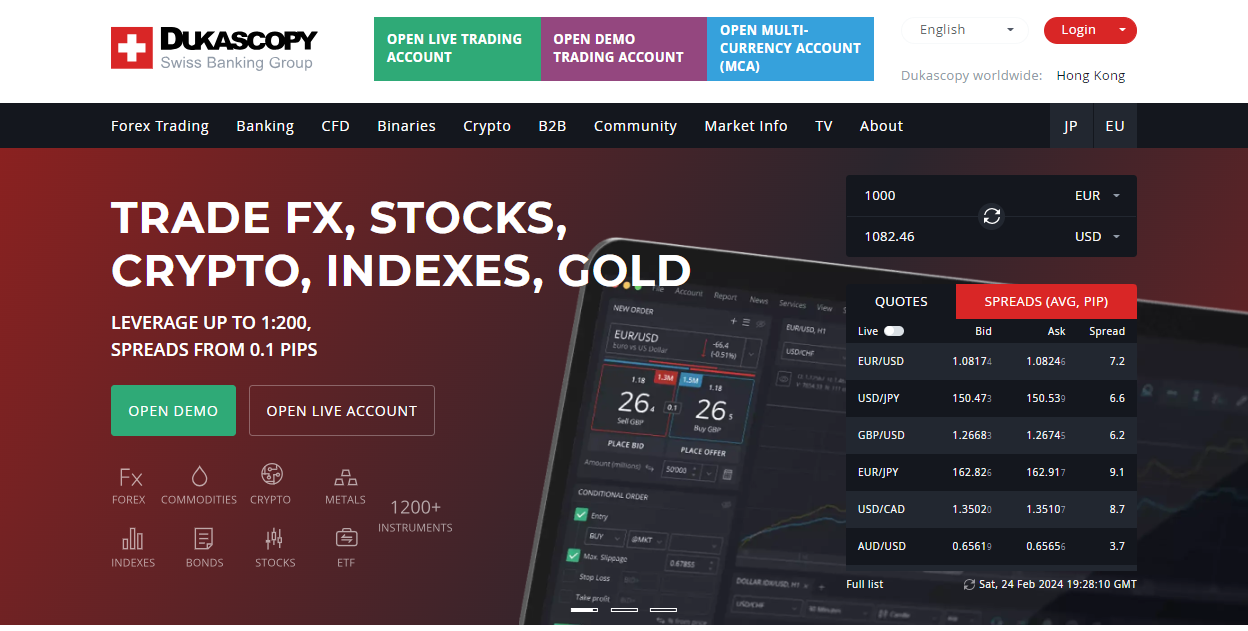

Dukascopy

Dukascopy Bank is a renowned Forex broker known for its robust ECN (Electronic Communication Network) trading environment, providing traders with direct access to interbank liquidity and institutional-grade pricing. With Dukascopy’s ECN model, traders benefit from fast execution, minimal slippage, and competitive spreads, enhancing their trading experience.

One of Dukascopy’s standout features is its proprietary trading platform, JForex, offering advanced charting tools, customizable indicators, and automated trading capabilities. The platform is highly regarded for its stability, speed, and flexibility, catering to the needs of both novice and experienced traders.

Dukascopy also offers a range of trading instruments, including currency pairs, commodities, indices, and cryptocurrencies, providing traders with ample opportunities to diversify their portfolios.

Regulated by the Swiss Financial Market Supervisory Authority (FINMA), Dukascopy prioritizes security and transparency, ensuring a safe and trustworthy trading environment for its clients.

Additionally, the broker provides comprehensive educational resources, market analysis, and responsive customer support, empowering traders with the tools and assistance needed to succeed in the Forex market. Dukascopy has a trust score of 90%.

| 🔎 Broker | 🥇 Dukascopy |

| 📈 Regulation | FINMA |

| 📉 Social Media Platforms | LinkedIn YouTube |

| 📊 Trading Accounts | Single retail trading account |

| 💹 Trading Platforms | Forex/CFD ECN Account. Forex MT4 Account |

| 💴 Minimum Deposit | $100 |

| ⚙️ Trading Assets | Forex Crypto Indexes Stocks Bonds Energy Au Commodities ETF |

| 💵 USD-based Account | ✅Yes |

| 💶 USD Deposits Allowed | ✅Yes |

| 🎁 Bonuses for traders | None |

| ➖ Minimum spread | From 0.0 pips |

| 🆓 Demo Account | ✅Yes |

| ☪️ Islamic Account | ✅Yes |

| 🚀 Open an Account | 👉 Click Here |

The Pros of Trading with Dukascopy will include:

✅ Dukascopy offers a robust ECN trading environment, providing direct access to interbank liquidity and competitive pricing.

✅ Dukascopy’s JForex platform is highly regarded for its stability, speed, and advanced trading tools, offering traders a seamless trading experience.

✅ Some traders may find Dukascopy’s customer support to be less responsive during peak trading hours or weekends.

✅ Traders with dormant accounts may incur inactivity fees, which could be a concern for those who do not trade frequently.

Dukascopy may offer fewer promotional offers or bonuses compared to other brokers, which could be a drawback for traders seeking additional incentives.

The Cons of Trading with Dukascopy may include:

✅ Dukascopy requires a relatively high minimum deposit compared to some other brokers, which may be a barrier for beginner traders.

While JForex offers advanced features, it may have a steeper learning curve for novice traders compared to more user-friendly platforms.

What is an ECN Forex broker?

An ECN (Electronic Communication Network) Forex broker operates a platform that connects traders directly to the global currency market. Unlike traditional brokers, ECNs provide direct access to liquidity providers, ensuring faster execution, tighter spreads, and transparent pricing. Traders can engage in real-time trading with institutional-grade liquidity and minimal interference.

In Conclusion

Overall, navigating the world of ECN Forex brokers demands careful consideration of trading features, spreads, regulatory compliance, and customer support. With the right choice, traders gain access to fast execution, tight spreads, and transparent pricing, enhancing their trading experience and potential for success in the dynamic Forex market.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all investors. Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Frequently Asked Questions

What is an ECN Forex broker?

An ECN (Electronic Communication Network) Forex broker operates a platform that connects traders directly to the global currency market. Unlike traditional brokers, ECNs provide direct access to liquidity providers, ensuring faster execution, tighter spreads, and transparent pricing.

What are the advantages of trading with an ECN broker compared to a traditional market maker?

Trading with an ECN broker offers several advantages, including faster execution, lower spreads, and access to deeper liquidity pools. Additionally, ECN brokers often provide more transparent pricing and fewer conflicts of interest, as orders are executed directly in the market.

How does ECN trading impact order execution speed and slippage?

ECN trading typically results in faster order execution speeds due to direct access to liquidity providers. Slippage may still occur during periods of high volatility, but it is generally minimized compared to trading with traditional market makers.

Can retail traders access ECN liquidity and participate in interbank markets?

Yes, many ECN Forex brokers cater to retail traders, allowing them to access ECN liquidity and participate in interbank markets alongside institutional traders. Retail traders can benefit from the same pricing and liquidity available to larger market participants.

What are the typical costs associated with trading on an ECN platform?

ECN brokers typically charge a commission per trade, which is separate from the spread. Spreads on ECN platforms are generally variable and can be very tight, sometimes starting from 0 pips. Traders should also consider other fees such as overnight financing charges and inactivity fees, which vary depending on the broker.